New Tax Changes Mean More Savings for Individuals and Families; Find out How Much You May Save with the New 2003 Tax Relief Estimator at www.turbotax.com

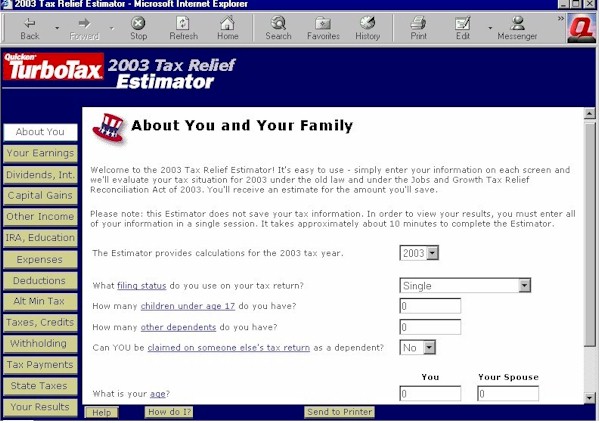

Mountain View, Calif., May 29, 2003 -- The new 2003 tax cuts may leave you wondering how much of the more than $350 billion from the new tax law will end up in your pocket. The tax experts at Intuit, the makers of TurboTax(R), can help you estimate your savings with the new 2003 Tax Relief Estimator at www.turbotax.com.

The new tax package includes provisions to lower income-tax rates, taxes on dividends and capital gains, and includes an increase in the tax credit for taxpayers with children under the age of 17 and provides tax relief for some married couples.

"There's something here for just about everyone," said Fred Grant, CPA, Senior Tax Analyst for Intuit.

-- Acceleration of the 2006 tax rate cuts to 2003

-- An increase in the child tax credit from $600 per child to $1,000 per child

-- Reduced tax rates on capital gains and qualifying dividends

-- Acceleration of tax relief for some married couples

-- An increase in the alternative minimum tax (AMT) exemption by $9,000 for married couples filing joint returns and $4,500 for single taxpayers

Visit our web site at www.turbotax.com

Contacts Intuit Colleen Ferrin, 858/525-7487 colleen_ferrin@intuit.com